By now, most property developers will be well aware of the credit crunch sweeping through the development finance sector. With limited funds at their disposal, development finance lenders are allocating funds on a preferential basis with a focus on existing client relationships – at the same time, lending criteria is adjusting. Lower LVRs and higher equity requirements are becoming a feature of property development funding approvals. There has also been a noticeable shift away from certain sectors of the residential market. In this blog, we break down how funding supply is reducing risk appetite and why certain sectors are falling out of favour in the realm of property finance in New Zealand.

Supply and demand

Adjustments in credit criteria can have a significant impact on how funds flow through the market.

Recently, a tightening in main bank credit criteria has resulted in an excess demand for funds in the non-bank market. This has occurred at a time when new building consents are at record highs and a strong pipeline of work is making its way through the system. The non-bank sector was quick to absorb the initial demand however it now appears that lenders are operating at near capacity (specifically within the construction and

development finance sector). As a result, non-bank lenders have similarly started to tighten.

It is commonly accepted that when lenders have excess funds, they are incentivised to loosen credit criteria. This is because lending specialists have (fixed) holding costsin the form of line fees or distributions to investors. This encourages lenders to quickly deploy funds to earn a return on their money, as required to maximise profitability. In contrast, a lender that is ‘fully lent’ is already maximising its profits and thus will be less inclined to write loans outside of standard credit policy.

It is worth noting that this supply demand imbalance is occurring at the same time as the development sector experiences a number of headwinds – something that we have extensively covered in previous blogs. So how are lenders adjusting their potential property development ffunding for the long term and the short term?

Sector Risk

In the residential property market, there are a plethora of sub-sectors, each with different risk profiles. Below we break down the distinguishing features of each sector in an attempt to shed light on why lenders are adjusting their risk profiles.

Standard Residential Property

In the property finance sector, completed houses are viewed as one of the ‘safer’ forms of lending. This market is characterised by high levels of liquidity with demand buoyed by both the owner-occupied and investor markets. This means that lenders can enter and exit positions with relative ease.

High levels of liquidity also support price transparency across the market. Most residential houses can also be quickly rented to generate holding income which can offset debt servicing requirements.

From a financing standpoint, because there is no ‘drawdown’ component to these loans (as with development loans), lenders earn an immediate return on their money. Furthermore, there is minimal ongoing management required. For the above reasons, lenders will often prefer lending in this sector rather than for property development lending.

Development & Construction Loans

Development finance has always been viewed as a riskier lending proposition than lending against standard residential properties. This is due to a variety of reasons including:

- Direct links to the construction sector which is prone to boom-and-bust cycles

- Exposure to commodity prices/raw materials

- Execution risk (including construction risk), development is a speciality skill set that requires expertise from all parties, including the developer, the contractor, and project consultants.

- Time delay between the commencement of a project and the expected completions date (the market can change during this period making a previously feasible project no longer viable

- Projects must be taken to completion to realise the value

Given the above, lenders will naturally look to reduce their exposure to this market when funds are limited compared to other lending propositions.

Land banks & Bare Land:

Bare land is considered a higher risk lending proposition – this is primarily due to how quickly land prices can adjust in response to minor adjustments across the broader housing market.

Higher-end values for completed housing stock have been instrumental in driving up land prices across the country over the past few years. This is because the GRV (gross realisable value) of a project is directly correlated to the underlying value of the land (i.e. what a developer can pay for the land). Any change to a project’s GRV has an outsized impact on underlying land value.

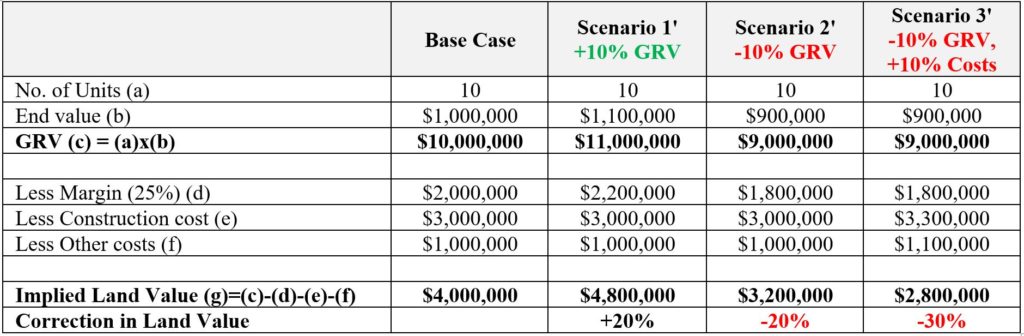

Take the below scenario where a developer is building 10 houses, which he expects to sell for $1m. This implies a GRV of $10m (being 10 units x $1M in revenue per house).

Now let’s assume the value of the completed units increases by 10% in line with the market. That is the GRV increases by $1M to $11M (GRV). In this instance, if the developer is happy with a 25% net return, and his costs are fixed, a 10% increase in end value implies the developer can pay an additional 20% for the underlying land. So, in this scenario, a 10% increase in GRV results in a 20% increase in land value.

The same principle applies to downward corrections, as can be seen in the below table. This is why development finance is a riskier proposition than funding completed houses.

Land corrects more aggressively in a downturn; hence you will find that most lenders have stricter lending criteria for land with the potential to develop. Lastly, the below table assumes that costs are fixed – increasing costs add further pressure on the as-is value of development land.

Looking ahead

Recently, we have seen over-trading in development land with an apparent disconnect between the underlying economic value of land prices relative to what people have been paying. In the near term, we expect to see a moderate softening in this market as some developers come to the realisation that their project is no longer feasible. Those that can afford to hold, will simply defer the project until such time as it does become feasible. While some will likely be forced to sell – presenting opportunities for others.

ASAP Finance are leaders in in New Zealand. Get in touch today for all your property finance needs.