Property Finance in New Zealand

“What are your rates and fees?” is perhaps the most frequently asked question by clients approaching ASAP property finance specialists for a construction loan. However, many developers do not take the time to consider how these costs are incurred over the life cycle of the property development project.

Unless you have built a cash flow model for a project, it is not something you will have seen in practice. Cash flow models are not necessary. However, understanding how interest and fees are incurred during the lifecycle of the project is extremely important as it can inform decisions that allow you to structure your debt in a cost-efficient way. This article focuses on interest repayments and the so-called ‘S-Curve’.

What is the S-Curve?

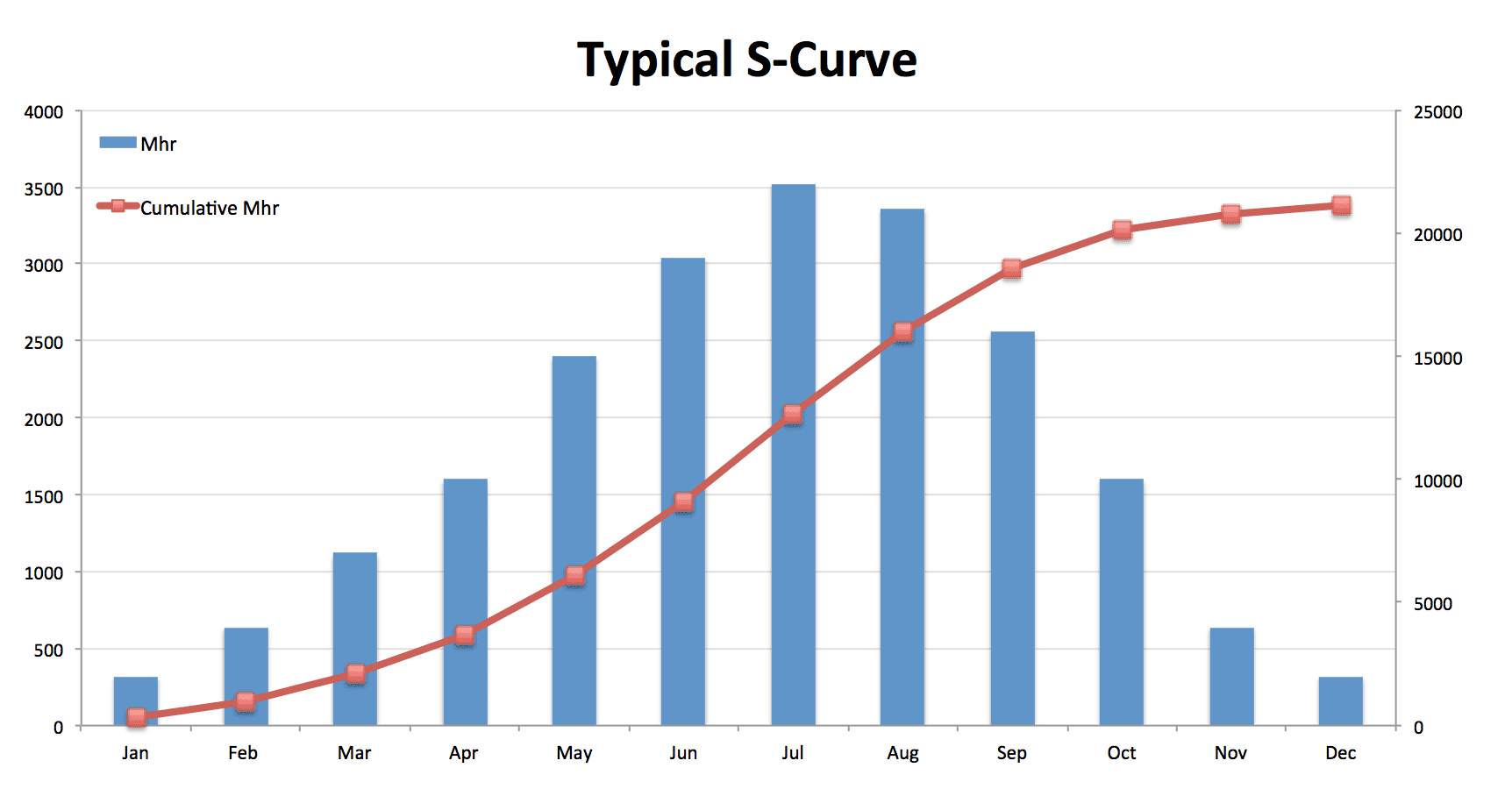

The S-curve relates to the shape produced by the typical flow of costs on a property development project. Most project costs are not spent linearly (or in a straight-line). You typically start by spending less per month during the early stages of the project (when you are in the planning phase). As you begin construction, costs per month ramp up until they ultimately reach a peak, generally once the project is fully closed in. After which, the total cost per month slowly starts to decline as construction winds down and you await title and CCC. The result, if you graph the cumulative cash outflows, looks like an ‘S’.

Read more about the Ins and Outs of Lender Fees for a better understanding of the so-called, ‘S Curve.’

Why does this matter?

The interest on property development loans is usually calculated on the drawn balance of the loan, i.e., how much money you are actually using (unlike establishment fees and line fees, which are charged against the facility limit).

This is important because funds are drawn down in stages for construction loans. This means that a 10% interest rate does not necessarily translate to a 10% cost. Assuming you draw down funds evenly (and a minimal initial advance) then the interest expense tends to work out to be around 6.5% of the facility limit or 65% of the headline interest rate.

For this reason, the timing of drawdowns can have a significant impact on the cost of borrowing. If a property development has large upfront costs, then it can significantly increase your interest expense. For example, having a large initial advance to facilitate settlement on the land, or using a building methodology that requires you to pay a large deposit to the manufacturer.

Conversely, if you have a project where most of the costs are incurred toward the end of the project, it can reduce your interest expense. When and where delays occur during the life cycle of your project can similarly impact your interest expense. For example, if you experience delays at the beginning of the project (when few costs have been incurred), the increased interest expense will not be as great as if the delay had occurred at the back end of the project when the loan facility is fully drawn.

Reducing your interest expense

- Put your equity into the project upfront. This will reduce the length of time that you are borrowing funds from your lender. Plan your project to ensure that you do not face delays at the end of the project. Waiting for LINZ and the council to grant approvals such as code compliance are perhaps two of the most time-consuming processes. Worse still, is that these delays occur at the end of the project while the facility is fully drawn thereby incurring significant interest costs.

- Titles: Complete works required to obtain individual freehold titles early on in the development. This may require you to upgrade infrastructure, install utility connections, or pour your driveway early. These works generally relate to s223c and s224c which are required to lodge for titles.

- CCC: Ensure that your builders’ bookkeeping is in order and that all necessary producer statements, warranties, and engineering sign-offs are procured from sub-contractors upon completion of works and not at the end of the project.

- Review your construction contract to ensure that there are no large upfront payments. You want your payments to the contractor to reflect the amount of work completed. Not only does this reduce interest costs, but it also reduces your risk to the builder’s financial position. For example, should the construction company be placed into liquidation, any funds advanced to work that has not been completed will likely be unrecoverable. This means you will incur these costs again when you engage another builder.

- Negotiate ‘liquated damages’ with your builder. A daily sum payable by the contractor to you (the developer) for every day that the builder is late delivering the project. These funds can be used to offset the additional interest expense incurred for the late delivery of the project. You may also want to consider an early completion bonus payable by you to your builder, should they finish the project ahead of schedule.