The Capital Stack

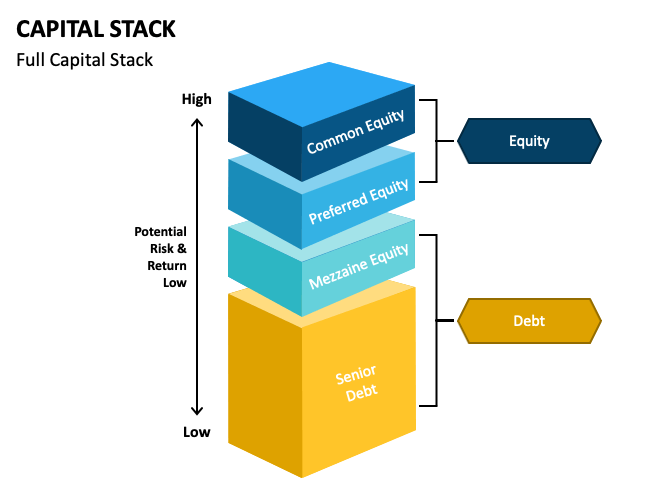

When it comes to property development, one of the most important concepts to understand is the capital stack. In simple terms, the capital stack refers to the different sources of financing that are used to fund a property development project. These sources of financing can include equity, debt, and other types of financing.

Understanding the capital stack is crucial for property developers, as it helps them to determine the most appropriate financing structure for their project. By carefully balancing the different sources of financing in their capital stack, developers can optimise their overall cost of capital relative to their expected return on investment.

Let’s take a closer look at the different components of a typical capital stack:

Senior Debt

Senior debt is typically the first layer of financing in a capital stack – such facilities are commonly provided by banks but also include non-bank lenders and finance companies (such as ASAP Finance).

Senior debt takes priority above all other financing including mezzanine debt and equity – priority is secured by way of a first ranking mortgage registered on the certificate of title of the property. Other securities such as General Security Agreements, Deeds of Assignment, Deeds of Priority and Subordination, Specific Security Agreements and Personal Guarantees are also common in development funding. These securities ensure the lender has the first claim to any proceeds of sale resulting from the development.

Lending criteria for senior debt facilities can vary greatly, however almost all will have loan-to-value and loan-to-cost requirements. Minimum equity contributions are also common, ensuring developers have skin in the game.

The priority status of senior debt makes it less risky, but as a result it also commands a lower return for the lender.

Mezzanine (Junior) Debt

Mezzanine debt or Junior debt is a type of financing that sits between senior debt and equity in the capital stack.

It is typically secured by way of a second registered mortgage (behind an existing first) or in some instances may be unsecured.

Because it ranks lower in terms of priority, mezzanine debt is higher risk lending and carries a higher interest rate than that of senior debt, however it is cheaper than equity funding.

Equity

Equity represents the capital that is invested in a project by its owners or investors. Equity investors take on the highest risk in a project, as they are typically the last to be repaid and have no guarantee of a return on their investment. However, they also have the potential to earn the highest returns if the project is successful. If a developer is short of their own equity, they can look to raise equity from investors however given the risks, it is also typically the most expensive form of financing.

Preferred Equity

Preferred equity is a type of financing that sits between mezzanine debt and common equity in the capital stack. It typically carries a fixed rate of return and priority over common equity investors in terms of repayment.

Common Equity

Common equity represents the ownership of the property development project. Common equity investors take on the highest risk in a project, as they are typically the last to be repaid and have no guarantee of a return on their investment. However, they also have the potential to earn the highest returns if the project is successful.

Why Does This Matter?

By carefully balancing the different sources of financing in their capital stack, property developers can create a financing structure that is both cost-effective and tailored to their specific needs. For example, a developer may choose to use more of equity in their capital stack to maximise returns, or more leverage (senior debt + mezz) if they are looking to maximise total returns on equity across multiple projects.

Overall, understanding the capital stack is crucial for property developers looking for property development funding. By carefully considering the different sources of financing available to them and creating a well-structured capital stack, developers can minimize their overall cost of capital and maximize their potential returns.