There are two key components to any initial loan assessment for development finance: a loan-to-value ratio (LVR) and a loan-to-cost ratio (LTC). Both are mathematical formulae, and both contribute to the success of your application. We have discussed LVRs in a previous blog post. Here, we break down the intricacies of its counterpart: LCRs.

If you’re readying yourself to apply for development costs, then you need to understand the ins and outs of these crucial figures. Read on for an explanation of how development costs, loan amounts, and equity contributions all combine to dictate the structure of your facility.

What is a Loan-to-Cost Ratio?

Loan-to-cost ratio is a method used in the property finance world that looks at the percentage of capital (contributed by the borrower/developer) in comparison to the total development costs. A property developer’s capital contribution can come in various forms and includes both cash contributions toward a project, and equity in an existing property. If the developer has not already purchased land, then their contribution will be a cash contribution either toward settling the land or funding soft costs. However, if a developer already owns the property which is to be developed, then their contribution is likely going to include equity held in the land.

The LTC ratio itself is a simple metric – if the developer is funding 20% of the Total Development Cost (“TDC”), either through cash or equity, then the remaining 80% will need to be funded by the lender. This forms the 80:20 loan-to-cost ratio which we regularly use at ASAP as benchmark in determining whether the borrower has sufficient capacity to undertake a project.

Total Development Costs

Foundational to the LTC ratio is a detailed development budget (the “C” in LTC). The development budget should encompass all costs required to take the project to completion. This includes land acquisition, soft costs, civil and construction costs, council levies and fees (such as development contributions), funding costs (interest and fees), and even an appropriate contingency. Sales/marketing commission is perhaps one of the only costs which can be excluded as it is an expense incurred after the completion of the project.

Soft costs and equity releases

In development funding, “soft costs” relate to professional fees – a large portion of which are incurred pre-development in order to obtain council consents and approvals. If the developer has incurred these costs before approaching the lender, they can be included as equity in LTC calculations; this reduces the need for the client to inject further equity into the project. Obtaining consents before you apply for development funding can be a good way to increase your equity contribution, it also removes the consenting risk from the project.

In instances where a developer is self-funding the initial stages of a project, equity releases may be possible. At ASAP Finance, we provide equity release solutions for our clients, which enables them to recoup funds they have invested into the project allowing cash to be deployed into another project. When seeking an equity release solution for a project that is mid-construction, it is essential that all council inspections are up to date and that producer statements and warranties are on hand. Having this paperwork in order will give the lender confidence that the build quality is in line with council requirements and that all appropriate contractors have been paid.

Marking to market

Fluctuations and increases in property prices can also influence a developer’s equity contributions. For example, a piece of land that was purchased in 2014 for $800,000 could very well be worth $1,200,000 today. This transpires to an equity uplift of $400,000 that should be considered when assessing the LTC ratio. Note, some lenders discount the value of equity uplift, as it is not a cash contribution.

What is a Good LTC Ratio?

A “good” ratio is a relative term. Most banks fund up to a maximum of 70% of TDC. Non-bank lenders who are privately funded have greater flexibility with their credit policy. Thus, non-bank lenders like ASAP Finance can fund a higher percentage of TDC – noting that 90% seems to be limit. Funding above this level is not feasible for most lenders, as it means taking on all the downside risk whilst failing to benefit from the upside gains. Funding above 90% of TDC may still be commercially feasible in joint venture arrangements where the borrower allocates a certain portion of the potential profits to the lender.

Skin in the Game

Why do lenders place minimum requirements on equity contribution? When property developers commit a certain percentage of funds toward the project, it means that they have skin in the game. Most lenders are reluctant to adopt all the risk, and it’s not just because of the lack of reward. Developers without an incentive to perform (equity) may take on additional risk that compromises the likelihood of the project succeeding.

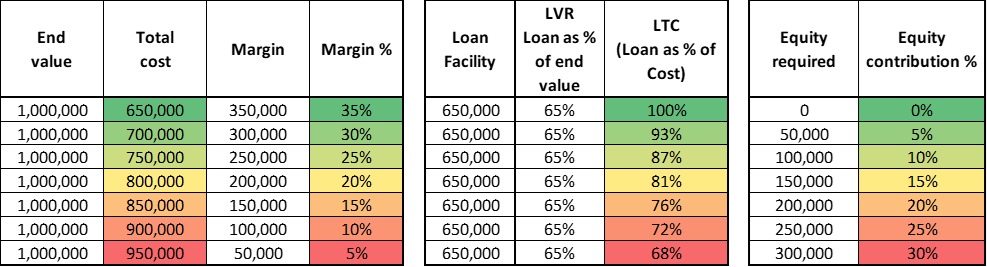

LVR, LTC and the development Margin

What do LVR’s and LTC’s tell us about the development margin?

Non-bank lenders will consider funding a higher percentage of TDC in instances where there is a high development margin in the project. This is because a higher development margin implies less costs – so up to 100% funding may be possible without compromising LVR limits.

Take a scenario where a lender imposes a static LVR of 65%. If the developer has a high margin project, then the lender will be able to fund a larger portion of the project with debt, and the developer will be able to reduce his equity obligation.

For developers seeking funding packages with high LTC’s; expect your lender to thoroughly stress test your development budget, and perhaps insist on increased construction and design contingencies. This is to ensure that the loan facility provided is sufficient to complete the project (see our blog on cost-to-complete funding).

Understand the development finance process from start to finish.

Here at ASAP Finance, we’re all about removing hurdles. We work with our clients to build bespoke loan facilities, walking alongside them in the development process to help them achieve success.

Talk to one of our experienced, business-minded lending managers about commercial loans, development finance, or loans to buy land today.