Category: Blog

Housing Price Rise Triggers Government Response

New Zealand Finance Minister Grant Robertson now requires the Reserve Bank (RBNZ) to consider the impact its monetary policy decisions have on house prices, following a revision to RBNZ’s remit. This has created some significant ripples in the property finance sector.

While the Government’s Monetary Policy Committee’s main objectives remain unchanged (targeting inflation and employment), the revised remit will increase focus and understanding on the Banks OCR decisions and the impact on house price sustainability.

Rising House Prices Need Attention

The rationale is simple—record-breaking low interest rates have bolstered demand for housing and credit, pushing house prices to astronomical levels. This change has called into question the Government’s stated commitment to improving housing affordability for all New Zealanders.

The revised remit stipulates the Government’s policy is to “support more sustainable house prices, including dampening investor demand for existing housing stock, which would improve affordability for first-home buyers.”

Robertson said the Committee could decide how its decisions take account of housing consequences, but it will need to explain how it has sought to assess their impacts regularly. The new remit takes effect from 1 March.

What does this mean for Monetary Policy?

The Monetary Policy Committee has stressed, “prolonged monetary stimulus” (low-interest rates) is necessary to protect employment and promote economic expansion following the economic shock caused by COVID-19. It said it would maintain the current policy until it was confident inflation is “sustained” at 2% per year, and employment is “at or above” its maximum sustainable level.

In this regard, we do not expect the revised remit to impact OCR decisions. In fact, the RBNZ openly opposed the New Zealand’s Governments initial proposal late last year to require it to consider house prices when setting monetary policy, arguing it would instead be made to view house prices through the way it regulates banks (through macro-prudential tools such as ‘loan-to-value ratios’ and ‘debt-to-income ratios’).

Despite such opposition, the new directive has been issued to the RBNZ (under section 68B of the Reserve Bank Act). In a statement from RBNZ Governor Adrian Orr, the Governor reinforced his previous comments, saying that the RBNZ’s actions are among “many” that influence house prices.

Restricted bank lending

However, finance minister Grant Robertson asked the RBNZ to provide advice on restricting borrowers’ debt-to-income ratios and interest-only mortgages.

“I want to understand the extent to which interest-only mortgages (particularly to speculators) pose risks to financial stability and whether restrictions should apply,” he said. He added that jurisdictions such as Australia have in the past applied restrictions on interest-only mortgages due to financial stability risks.

He said he had already made clear in principle that he would want these to apply only to investors, thereby impacting those wishing to attain investor loans. “It’s important that any potential restrictions do not disproportionately affect first-home buyers and low-income borrowers,” said the finance minister.

Orr had earlier told the media that he did not share Robertson’s view. Orr said: “It is incredibly difficult to segment any market and any individual with macro-prudential tools. The phrase “macro” means it’s the same tool for all. So, pretending we could fine-tune for a particular set or groups comes with great challenge and implications.”

The RBNZ has already applied more onerous loan-to-value ratio (LVR) restrictions on residential property investors than it has on owner-occupiers, requiring them to have larger deposits when taking out mortgages.

Should the Government agree with the RBNZ’s recommendations, it would not be surprising to see debt-to-income ratios and restrictions on interest-only loans implemented in 2021. While such measures may take some heat out of the market, the single most crucial factor driving current market conditions remains interest rates.

Navigate the property finance world with an expert lending manager from ASAP Finance.

Want to know more about the financial world or obtain a construction loan of your own? Talk to one of our experienced, business-minded lending managers today; we can help you get your project off the ground.

How the new LVR restrictions will impact lending

As has long been forecasted, the Reserve Bank of New Zealand (RBNZ) has now moved to reinstate higher Loan to Value ratios(LVRs). There were no restrictions last year, meaning buyers could potentially purchase a home while putting down a smaller down payment. However, the property market has since boomed, prompting the RBNZ to consult interested parties on whether to reinstate the LVRs.

The government seems to have been the only party surprised with the housing market’s vigorous rebound over the past year. Now, the government is predictably encouraging the RBNZ to try and slow down the rally in property prices. In this blog post, we’ll review why the LVR restrictions have been reinstated, what the predicted results are, and how this will impact commercial and residential development finance.

Why reinstate Loan-to-Value Ratio restrictions?

Prompted by the government and the expanding house price bubble, this move to reinstate LVR restrictions is expected to slow the surge in house prices, but not until the second half of 2021. The RBNZ has announced that it will be cracking down on bank lending to residential property investors and will reinstate the tougher LVR restrictions that were in place last year. From May 1, at least 95% of new bank lending to residential property investors will have to go to borrowers with deposits of at least 40%. Essentially, the RBNZ is targeting residential property investors with new, higher LVR restrictions. Generally, most commercial investors will once again need 40% deposits, while most owner-occupiers will need 20% deposits.

As an interim measure, from March 1 to April 30, this deposit requirement will be set at 30%. The RBNZ says it is taking a “staged approach” to enable banks to manage their pipelines of loan applications that have been approved, but not yet settled. However, it expects lenders (both banks and non-bank lenders ) to respect the 40% rule “immediately with all new loan approvals”.

As for owner-occupiers, from March 1, at least 80% of new bank lending will need to go to borrowers with deposits of at least 20% – the level LVRs were at before removal last year.

What does this mean for investors and owner-occupiers?

In a press release from the NZ Property Investors Federation executive officer Sharon Culwick was quoted, claiming that the move would inevitably slow down the housing market, making it harder for first home buyers and investors to enter the market. “’The larger deposits required may not stop those people who are looking for an investment option, which is an alternative to the extremely low term deposit rates offered by the banks,’ said Culwick.”

She noted that during the last year, there had been a significant increase of new investors entering the market. And that those investors had purchased on the proviso that house prices would continue to rise at the same levels recently seen.

“Capital gains, however, should only be considered a bonus and not be relied upon,” she said, adding: “In any case, these Reserve Bank restrictions may not make a significant difference to some property investors who have already been hindered by the banks’ internal Debt-To-Income and serviceability rules over the last two years. These restrictions are an internal process that safeguards the financial stability of banks.”

In the words of RBNZ…

RBNZ Deputy Governor Geoff Bascand says LVR restrictions were removed last year “to ensure they didn’t interfere with COVID-19 policy responses aimed at promoting cash flow and confidence.

“Since then, in part due to the success of the health and economic policy responses, we have witnessed a rapid acceleration in the housing market, with new records being set for the national median price, and new mortgage lending continuing at a strong pace,” Bascand said. “We are now concerned about the risk a sharp correction in the housing market poses for financial stability. …A growing number of highly indebted borrowers, especially investors, are now financially vulnerable to house price corrections and disruptions to their ability to service the debt.”

The Reserve Bank has warned that the overheated housing market is at growing risk of a correction necessitating the changes. However, The NZPIF does not believe the new regulations will have any impact on the housing crisis, which is largely driven by lack of supply. “If anything, housing stock for rent will be gradually reduced as property investors are prevented from entering the market. This will put more pressure on those groups who are already struggling to find a place to live,” said Culwick.

Therefore, property investors and owner-occupiers alike need to have the right tools and expertise at hand to navigate these reinstated conditions. For investors in particular, the expert team at ASAP Finance can help.

Discuss your investment plans with the expert team at ASAP Finance.

Beyond the see-saw of LVR restrictions imposed by the RBNZ, supply demand considerations remain a key focus at ASAP Finance. We continue to work hard to ensure adequate funding is made available to our clients for residential developments. It is here that we know we can make the most difference, by doing our part to ensure the successful delivery of new housing stock to the New Zealand property market.

Guide to the National Policy Statement on Urban Development 2020

New Zealand recently adopted a major change in urban environment planning that is expected to lead to significant upturns in the world of property finance.

Gazetted on July 23rd and pushed into effect on August 20th of 2020, the National Policy Statement on Urban Development (NPS-UD) is an evolution on previous government documentation surrounding development in urban areas.

Developed by the Ministry for the Environment and the Ministry of Housing and Urban Development, this new statement contains objectives and policies that councils must give effect to in their resource management decisions.

The NPS-UD is aimed at improving development capacity for housing and business – putting New Zealand communities on the path to well-planned urban areas and ensuring a well-functioning urban environment is created for all. With some 86% of New Zealanders living in urban areas, the need for considered planning rules has never been greater.

For developers, homeowners, and stakeholders alike, the release and implementation of this statement heralds some significant changes to both development capacity and development rates. Understanding the intention behind the NPS-UD 2020 will be key to delivering projects that not only maximise development potential but enhance the urban environment.

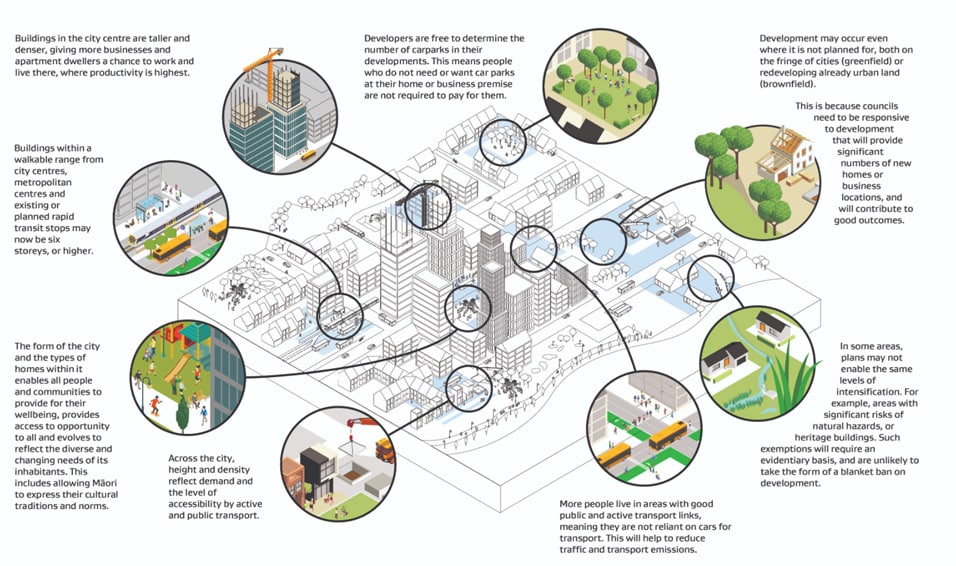

The Major Policy Breakdown for NPS-UD 2020

In simple terms, the NPS-UD seeks to “improve the competitiveness of New Zealand’s urban land markets through greater flexibility in urban policy”. It is wide reaching and applies to all local authorities that have all or part of an urban environment within their district or region.

A targeted approach has been adopted to ensure that policy objectives and planning responses are matched to areas of high growth and base populations. This has been done by categorising territorial authorities into three Tiers; where Tier 1 is comprises the larger cities of Auckland, Hamilton, Tauranga, Wellington, and Christchurch. It is these authorities that are poised for the greatest change.

Most of the provision in the NPS-UD are aimed at developing urban areas in a way that combat high land prices, unaffordable housing, and improved access, however, three are key.

(1) Intensification (Polices 3, 4 & 5)

(3) Responsive Planning (Policy 8)

(2) Car parking (Policy 11)

Other policy’s outcomes more broadly address the ‘who’ and the ‘how’ of the policy package.

will be key to delivering projects that not only maximise development potential but enhance the urban environment.

Intensification (3, 4 & 5)

The intensification policy places minimums on development capacity required to meet expected demand for housing over the short, medium, and long term.

This required territorial authorities to provide land that is plan enabled (zoned), infrastructure ready and feasible.

Expect greater building height and density requirements in urban regions, particularly in areas of high demand (i.e. brownfield development).

One such example is the requirement for Tier 1 urban environments to enable:

“building heights of least 6 storeys within at least a walkable catchment of the following:

- existing and planned rapid transit stops

- the edge of city centre zones

- the edge of metropolitan centre zones”

Intensification policies are essential to the uncoupling of land prices from dwelling prices in high amenity areas. An image of success for this policy would be a city centre with taller, denser buildings, allowing more businesses and apartment dwellers to live where productivity is highest.

Car parking (8)

Territorial authorities will be required to remove minimum car parking requirements; enabling developers to determine the appropriate number of car parks (if any) for their development. With land prices at record highs, the goal of this policy is to enable the private market to determine the highest and best use of land.

At ASAP Finance, we are already seeing a number of projects being planned with minimal to no car parking. These developments have been well located and have had easy access to public transport.

Another sector of the market expected to benefit from this policy is small format retailer, where bulk retailers such as Bunnings and the Warehouse have traditionally enjoy benefited from minimum carpark requirements as they have possessed the scale and balance sheet to acquire larger parcels of land.

Responsiveness (8)

The responsive development policy is targeted toward increasing land use flexibility and improving land supply through greenfield development. This specifically targets areas that are expected to fall within high labour market catchment areas but where the underlying land is not currently zoned.

Councils are now required to consider private plan changes in places where development was not previously planned. This only applies where the said development would increase development capacity, contribute to a well-functioning urban environment, is well connected to transport corridors and other broader considerations that would contributing to a good community outcome.

Strategic planning

In addition to the direct initiatives described above, compliance and reporting regimes will indirectly influence NPS-UD outcomes. Housing and Business Assessments (HBA) and Future Development Strategies (FDS) have been created and are supportive of wider policies. As previously mentioned, these polices concern the ‘who’ and the ‘how’.

Where the purpose of the HBA is to provide information on demand & supply of housing and business land. It also quantifies what is considered sufficient development capacity. The HBA feeds into the FDS which broadly stipulates how councils are to plan for growth.

Evidence and engagement

The final major policy stipulates that councils must provide a strong evidentiary basis to substantiate all development decision making. Notably, these decisions must always be in consultation with local iwi (per Te Tiriti O Waitangi), as well as local developers and infrastructure providers. This will ensure communities are progressing in a way that reflects the ever-changing needs of their inhabitants.

Why change it now, and what is different from the NPS-UDC 2016?

While the NPS-UDC 2016 was created as the precursor to this new policy statement, the objectives and policies laid out in 2016 have not been as effective as projected. An overly constrained development landscape and property market have made it tough for people to build the homes they want, where they want them to be.

Therefore, certain spots in urban environments become more coveted than others, driving up the price, thus making them accessible only to those with a certain level of wealth. These pieces of land are usually located in convenient places with high amenity.

The natural progression of these events is that people below a certain level of wealth have poor access to transport, employment, and social services. This disproportionately impacts on vulnerable communities, showing some major gaps in the thinking that led to the NPS-UDC 2016.

Key changes in the NPS-UD 2020

This new policy is more directive than its predecessor, giving councils clear guidance and oversight to ensure all regions are working toward better urban outcomes. In other words, to make sure cities are built with all people in mind.

Key changes to the policies include:

- a requirement for planning decisions to contribute to well-functioning urban environments (as defined in Policy 1 of the NPS-UD), which is at the core of all the policies in the NPS-UD

- specific reference to amenity values, climate change, housing affordability and the Treaty of Waitangi (te Tiriti o Waitangi)

- a requirement for local authorities to enable greater intensification in areas of high demand and where there is the greatest evidence of benefit: city centres, metropolitan centres, town centres and near rapid transit stops

- removal of minimum car parking rates from district plans

- a requirement for local authorities to be responsive to unexpected plan change requests where these would contribute to desirable outcomes.

Each council will be required to produce a Future Development Strategy, with clearly outlined steps to achieving an urban environment that meets the above requirements. The earliest deadline for the FDS is in 2024.

Implications for Urban Property Developers

“Such collaboration will allow the sector to move beyond the never-ending cycle of sole-planning stages and into the implementation and delivery of developments that shape cities and enable communities to thrive.”

Leonie Freeman, Property Council CEO

With the recent advent of COVID-19, the New Zealand economy has been in a state of perpetual flux. While property developers have not been as deeply impacted as other sectors in New Zealand, this flux has resulted in a certain degree of uncertainty for anyone investing in property.

Now that the NPS-UD has been pushed into effect, Tier 1 local authorities (including Auckland), have two years to implement the intensification policies laid out. They will also have eighteen months to remove all car parking provisions from any plans or developments. However, expect the National Policy Statement on Urban Development (NPS-UD) to influence Resource Management Act consenting decisions immediately.

The door is now open for Kiwi property developers to work collaboratively with their local authorities to meet a certain level of intensification. Similarly, councils will be more likely to approve urban development plans that meet their needs, and more likely to work with the developer to rectify any issues should the plans not quite measure up.

Councils are now required to consider developments in both greenfield and brownfield areas, so long as they could contribute to fulfilling intensification and improve housing outcomes. Car parks will no longer be a requirement, easing development cost and enabling larger buildings and more green space.

It is now up to the private sector to determine how they can have a hand in shaping the future of New Zealand cities. With luck, developers should be able to shift their focus away from the minutiae of bureaucracy and onto the planning, implementation, and construction of buildings that advance New Zealand cities forward. With surety like this, attaining development finance will be more likely. It all comes full circle.

For more information on the NPS-UD 2020 or Future Development Strategies, follow the links below:

- Guidance on Implementing the NPS-UD 2020

- Breakdown of the National Policy Statement on Urban Development 2020

- Introductory Guide to the NPS-US 2020 from the Ministry for the Environment

- Predicted Outcomes from the NPS-UD 2020

- The National Policy Statement on Urban Development Capacity 2016

Get a head start and ride the wave upward. Talk to ASAP Finance for hassle-free development finance.

We are New Zealand’s market leaders in development finance, offering everything from residential property loans to joint venture property development opportunities. We’re all about removing the hurdles in your way. To get your development off the ground, speak to one

We’re all about removing the hurdles in your way. To get your development off the ground, speak to one

Breaking Down Loan-to-Cost Ratios in Development Finance

There are two key components to any initial loan assessment for development finance: a loan-to-value ratio (LVR) and a loan-to-cost ratio (LTC). Both are mathematical formulae, and both contribute to the success of your application. We have discussed LVRs in a previous blog post. Here, we break down the intricacies of its counterpart: LCRs.

If you’re readying yourself to apply for development costs, then you need to understand the ins and outs of these crucial figures. Read on for an explanation of how development costs, loan amounts, and equity contributions all combine to dictate the structure of your facility.

What is a Loan-to-Cost Ratio?

Loan-to-cost ratio is a method used in the property finance world that looks at the percentage of capital (contributed by the borrower/developer) in comparison to the total development costs. A property developer’s capital contribution can come in various forms and includes both cash contributions toward a project, and equity in an existing property. If the developer has not already purchased land, then their contribution will be a cash contribution either toward settling the land or funding soft costs. However, if a developer already owns the property which is to be developed, then their contribution is likely going to include equity held in the land.

The LTC ratio itself is a simple metric – if the developer is funding 20% of the Total Development Cost (“TDC”), either through cash or equity, then the remaining 80% will need to be funded by the lender. This forms the 80:20 loan-to-cost ratio which we regularly use at ASAP as benchmark in determining whether the borrower has sufficient capacity to undertake a project.

Total Development Costs

Foundational to the LTC ratio is a detailed development budget (the “C” in LTC). The development budget should encompass all costs required to take the project to completion. This includes land acquisition, soft costs, civil and construction costs, council levies and fees (such as development contributions), funding costs (interest and fees), and even an appropriate contingency. Sales/marketing commission is perhaps one of the only costs which can be excluded as it is an expense incurred after the completion of the project.

Soft costs and equity releases

In development funding, “soft costs” relate to professional fees – a large portion of which are incurred pre-development in order to obtain council consents and approvals. If the developer has incurred these costs before approaching the lender, they can be included as equity in LTC calculations; this reduces the need for the client to inject further equity into the project. Obtaining consents before you apply for development funding can be a good way to increase your equity contribution, it also removes the consenting risk from the project.

In instances where a developer is self-funding the initial stages of a project, equity releases may be possible. At ASAP Finance, we provide equity release solutions for our clients, which enables them to recoup funds they have invested into the project allowing cash to be deployed into another project. When seeking an equity release solution for a project that is mid-construction, it is essential that all council inspections are up to date and that producer statements and warranties are on hand. Having this paperwork in order will give the lender confidence that the build quality is in line with council requirements and that all appropriate contractors have been paid.

Marking to market

Fluctuations and increases in property prices can also influence a developer’s equity contributions. For example, a piece of land that was purchased in 2014 for $800,000 could very well be worth $1,200,000 today. This transpires to an equity uplift of $400,000 that should be considered when assessing the LTC ratio. Note, some lenders discount the value of equity uplift, as it is not a cash contribution.

What is a Good LTC Ratio?

A “good” ratio is a relative term. Most banks fund up to a maximum of 70% of TDC. Non-bank lenders who are privately funded have greater flexibility with their credit policy. Thus, non-bank lenders like ASAP Finance can fund a higher percentage of TDC – noting that 90% seems to be limit. Funding above this level is not feasible for most lenders, as it means taking on all the downside risk whilst failing to benefit from the upside gains. Funding above 90% of TDC may still be commercially feasible in joint venture arrangements where the borrower allocates a certain portion of the potential profits to the lender.

Skin in the Game

Why do lenders place minimum requirements on equity contribution? When property developers commit a certain percentage of funds toward the project, it means that they have skin in the game. Most lenders are reluctant to adopt all the risk, and it’s not just because of the lack of reward. Developers without an incentive to perform (equity) may take on additional risk that compromises the likelihood of the project succeeding.

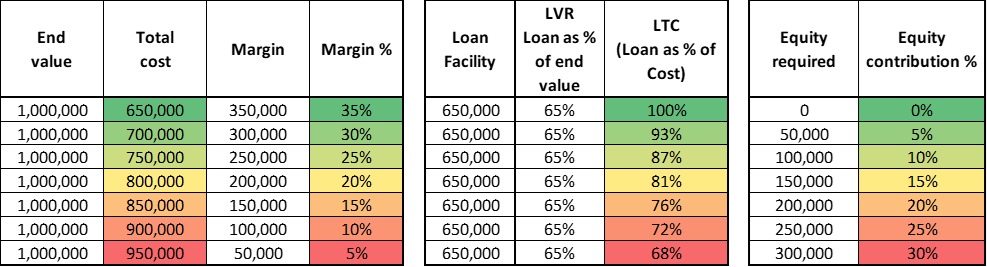

LVR, LTC and the development Margin

What do LVR’s and LTC’s tell us about the development margin?

Non-bank lenders will consider funding a higher percentage of TDC in instances where there is a high development margin in the project. This is because a higher development margin implies less costs – so up to 100% funding may be possible without compromising LVR limits.

Take a scenario where a lender imposes a static LVR of 65%. If the developer has a high margin project, then the lender will be able to fund a larger portion of the project with debt, and the developer will be able to reduce his equity obligation.

For developers seeking funding packages with high LTC’s; expect your lender to thoroughly stress test your development budget, and perhaps insist on increased construction and design contingencies. This is to ensure that the loan facility provided is sufficient to complete the project (see our blog on cost-to-complete funding).

Understand the development finance process from start to finish.

Here at ASAP Finance, we’re all about removing hurdles. We work with our clients to build bespoke loan facilities, walking alongside them in the development process to help them achieve success.

Talk to one of our experienced, business-minded lending managers about commercial loans, development finance, or loans to buy land today.

What Unconventional Monetary Policy Means for Investors

COVID-19 has caused widespread disruption across global markets resulting in job losses and economic hardship. In response, countries across the globe have been implementing economic policy to soften the blow of the current crisis. In New Zealand, the Reserve Bank’s response was swift, immediately lowering the OCR from 1% to 0.25%, and announcing (what would become) a NZ$100B bond buying programme. These measures were considered necessary to lower borrowing costs and to achieve the banks inflation and employment targets.

Acknowledging that further monetary stimulus would be required, the RBNZ asked trading banks to prepare for alternate monetary policy including negative interest rates and a funding-for-lending programme (FLP). Trading banks were advised to prepare for these policies before year end with the Reserve Bank recently announcing that the FLP would commence in December 2020. Property finance companies geared up for change. Investors wait for what the end of the year would bring.

Below we explore these new policies and how they may impact New Zealand households and businesses – the future on which New Zealand’s economy now relies upon.

How do interest rates impact economic activity?

New Zealand businesses and consumers are the lifeblood of our economy – they are what will keep the country’s economy turning. However increased uncertainty may lead many people to sit on the side-lines, deferring consumption and investment decisions until a more certain future is evident. This decline in economic activity threatens jobs and creates deflationary pressures on pricing. To mitigate these risks, lower retail interest rates are needed to stimulate economic activity – where lower rates would reduce funding costs and improve cashflow for households and businesses.

The Reserve Bank cannot directly control retail interest rates – they only influence wholesale rates. Trading banks hold deposit accounts at the Reserve Bank, where the Official Cash Rate (OCR) is the interest rate the Reserve Bank pays trading banks on their deposits. When the OCR is moved down, it reduces a banks cost of funds. The flow on effect to retail interest rates is simply a result of open market competition amongst the various trading banks.

With the OCR at just 0.25%, the RBNZ has little room to lower it further – hence the need for the RBNZ to explore a negative OCR.

How would Negative Interest Rates work?

A negative OCR simply means that banks would be charged to hold cash on overnight deposit accounts. This would incentivise banks to lend or invest their funds in order to avoid paying a holding cost, providing stimulus to the economy. In this sense, a negative OCR influences economic activity with the same strength as a positive OCR.

For household and businesses, lending and deposit rates would decline but do not expect to see them go negative. Retail mortgage rates are set based on a margin, in accordance with funding requirements and broader risk assessments. This margin would be applied to lending to ensure that retail mortgage rates remain above zero. For deposit rates, they will get near to zero but there is a limit as to how low they can go – the closer to zero deposit rates get, the less incentive customers have to deposit funds with a bank. This is an important consideration as deposits are a critical source of funding for banks.

Will the RBNZ move into negative territory?

The New Zealand economy has been surprisingly resilient across key measures of employment, household spending, GDP, and asset prices. The housing sector in particular has performed exceedingly well, with the RBNZ now expecting house prices to increase by 10% for 2020. A complete reversal from the 10% decline predicted earlier this year. With this in mind, the likelihood of the Reserve Bank adopting negative rates is slim.

For now, its priority is on implementing its funding for lending programme (FLP) which will see the Reserve Bank offer low-cost, secured, long-term funding for banks to on-lend to retail customers. Doing so will lower retail interest rates (in a similar manner to a negative OCR) without putting bank deposit funding at risk. The programme will be rolled out in December 2020 and the Reserve Bank expects the size of the programme to reach NZ$28B.

What does this mean for you?

We are entering unchartered territory so it would be amiss to state that anyone knows how this will play out. One of the reasons the Reserve Bank is looking to deploy unconventional monetary policy is because risk factors that threaten to undermine its employment and inflation targets remain present. The economic downturn has not been felt equally by all New Zealand businesses and future growth remains contingent on further stimulus. Current policies continue to point to lower interest rates which should put a floor under asset prices, particularly within housing (with upside potential). Substantial demand remains across both the investor and owner-occupiers’ sectors, and we expect the low interest rate environment to compress yields across the board.

Invest in the commercial market with experts at your side

Here at ASAP, we believe in collaborating with our clients. We offer a variety of development finance solutions including joint venture arrangements and underwrites. Talk to one of our expert lending managers today.

Market Update and Impact of General Election

The past few months have been a wild ride for those involved in Property Finance. It was only a few months ago that NZ was reeling from nationwide lockdown and mainstream economists were predicting house price declines between 7 and 15 per cent. However, the New Zealand housing market has fared far better than expected, and many economists and lending institutions (including the RBNZ) are now having to revise their forecasts upward.

It would seem that the strength of the government’s fiscal response and RBNZ’s unwavering commitment to keep rates low were largely underestimated. House price data published by REINZ for September 2020 confirmed record breaking volumes and sale prices across the country. For September, median house prices across NZ increased by 14.7% YOY to a new record high of $685,000, while Auckland’s median house price increased by 12.6% YOY to $955,000 (also a new record high).

Perhaps the most obvious shift in buyer sentiment has been visible in auction rooms where bidding wars are now the norm, not the exception. In our experience, properties that have attracted the most attention are those that have immediate development potential or large land holdings (land banking). Developers have come to the realisation that under the unitary plan, townhouse developments can be accommodated on almost any residential zone (with the exception of residential single house). The increase in property values that has occurred over the past six months (particularly for development sites) has been astonishing to witness considering the weakened state of the local economy.

With all eyes on COVID-19 and subsequent rebound, the General Election’s has almost been entirely overlooked by market pundits. As property people, it is important to keep our ears to the ground regarding potential policy changes, limitations, and regulations around the property market. Below we explore the impact elections have historically had on the property market and policy changes that are worth keeping an eye on moving forward.

Past Elections and Their Effects on the Property Market

Historically, the approach of a General Election has always drawn the eyes of investors and owner-occupiers. This is because a change in government can result in changes to policy and regulation that can ultimately impact how people spend their money. Taxes and regulation that are likely to increase the costs of owning property will result in investment away from the sector while an easing of regulation and reduction of costs will incentivise investment.

It is important to note that investor and owner-occupied markets are two different sectors and government policy has similarly made a clear distinction between them. Historically, the investor market has been the focus of regulation and tax adjustments while the owner-occupied market has been largely left alone.

Colliers’ monthly research report on New Zealand’s property market provides interesting insights around the six most recent NZ General Elections. By plotting the total monthly sales, national monthly building consents, and net optimism versus pessimism around the six elections, Colliers uncovered some key statistics.

- The prospect of potential changes to housing policy will, in most cases, influence the residential investor sector to a greater extent than owner-occupiers.

- Investor sentiment in the commercial and industrial sectors typically dips slightly before each General Election as people wait for the certainty of an elected government.

- Apart from that, 5 out of 6 elections showed little divergence in residential, commercial, and industrial sales activity from month to month.

- One election period (the 2014 General Election) had a noticeable shift in buying activity. Average monthly sales three months prior to the election were sitting at 5,680. Once the election was over, that figure surged to 7,032 sales for the following three months. Why did this happen?

The 2014 General Election

In 2014, the Labour party promoted a Capital Gains Tax as well as restrictions on the ability of overseas entities to buy Kiwi residential properties. These restrictive policies prompted property investors to take a step back as they grappled with the uncertainty of potential policy changes that could affect their assets.

National opposed Labour’s stance on these policies, and once National won the General Election in 2014, the investment property market surged with renewed vigour.

Colliers cited one particularly interesting statistic, as it sheds light on the differing effects of restrictive policies for investors and owner-occupiers:

“Total mortgage lending to investors increased from $1.167 billion in August 2014, a month prior to the election, to $1.421 billion in October, an increase of 21%. The uplift for first home buyers and other types of owner-occupiers was just 8.6%”.

– Colliers NZ August Research Report

This significant change in investment lending indicates that owner-occupiers did not hold back nearly as severely as investors in the approach to the election, as the new restrictive legislation held no significant barriers.

What about 2020?

For the coming election, predictions are erring towards minimal changes in the property market. At the time of writing, no significant restrictive legislation around property has been brought to light by either of the dominant parties and the notion of a “capital gains” tax appears to have been forgotten. That being said, below we explore some of the policies that are likely to be key determinants for investors and developers over the coming term.

Labours introduced the Healthy Homes Standards in 2019, which set minimum heating, insulation, ventilation, moisture and drainage. The new standards are to apply to new tenancies entered into after 1 July 2021 (and to all rental homes from 2024). This will require investors to upgrade their rental properties if they do not meet the required code.

National says the current government’s Healthy Homes standards are unfair on landlords and should be relaxed. National has also stated that they would repeal the Residential Tenancies Amendment Act including changes to no longer allowing landlords to end a periodic tenancy without a reason. In this sense, a national win would see more favourable terms offered to property investors.

For developers, perhaps the greatest change could come from repealing the Resource Management Act (RMA). The repealing of the RMA has been endorsed by Act and National for some time however in a pollical U-turn, Labour too has put their backing behind this motion. The RMA imposes overly restrictive planning rules on developers and home builders; where replacing the RMA with a separate Environmental Protection and Urban Development Act could see increased development activity and improved housing affordability. Part of this process involves the removing the Metropolitan Urban Limit. Ultimately the effectiveness of any such policy will lie in its delivery.

Beyond the above, it is fair to say that the immediate future of the New Zealand property market resides not in political changes or policy but rather the economic, financial, and demographic changes resulting from COVID-19. Thus far, sales and investment activity has remained strong and we continue to talk to investors and developers as to ways they can leverage their strong cash positions in the low interest rate environment. We expect investment in property to accelerate as the country pulls out of the recession.

Get continued insights and a partner in the property development process.

ASAP Finance is the leading non-bank lender for property in New Zealand. Our lending managers are also actively involved in the property market as developers and investors; this makes them ideal partners in your own property development journey. Speak to one of our lending managers about your next residential development or commercial and industrial property loans today.

Loan to Value Ratios: What You Need to Know

The loan-to-value ratio (LVR) is one of the most common and widely used metrics in the world of property finance. For financiers, it is broadly used to manage and mitigate credit risk when creating a loan facility. For property developers and investors, understanding LVRs and their application in credit analysis will provide insight as to the likely challenges you will face when seeking a loan, as well as assist in identifying the best finance partner for your project.

It is important to remember that the simple loan-to-value ratio is only one metric used by lenders to assess credit risk. Other considerations extend to: the capacity of the client, past performance, the team of people appointed to the project (and their relevant experience), the form of pertinent contracts, relevant consents and a projects feasibility. Such considerations are generally summarised within the 5Cs of credit.

We’ve created this article to explain LVR’s and their implementation in development finance – enabling you to head into the lending process with your eyes wide open.

The Loan-to-Value Ratio

The loan-to-value ratio is a percentage that indicates how much of a property’s value is funded by debt vs. borrower’s equity (cash or otherwise). For example, if a property is worth $1,000,000 and the borrower has current borrowings of $800,000 the LVR would be 80%. A higher LVR is typically associated with greater credit risk, as there is less margin of safety for the lender between the funds lent and the property’s value.

LVRs and property type

Each class of property (residential, investment, commercial, industrial, bare land etc.) has its own unique set of characteristics which influence the risk profile of the property class. In response, and to take the variable risk profile of each asset class into consideration, lenders look to adjust their LVR’s.

For example, most lenders adopt a lower maximum LVR when lending against vacant residential land (50–65%) than they do when lending against a residential dwelling (up to 90%). This is because bare land usually has no holding income, requires improvement to be enjoyed, and has a shallow buyer pool when compared to standard residential property, making it more susceptible to price corrections.

Development loans – As-is & complete values

When putting a development loan facility in place, a lender will assess LVR positions both at the start and at the end of the development. A lender will ask:

- what is the initial exposure? (being the initial advance vs. as-is value), and

- what is the end exposure once the project is complete? (development facility limit vs. the projects completed value)

A development facility can split into an upfront initial advance, and a progress payment facility (used to fund the build). The initial advance is secured against the value of the property on an as-is basis (this tends to be land only). In instances where there is an existing dwelling on site, it is often removed during the early stages of the development to enable civil works; therefore, no value is attributed to it.

A skilled lender will ensure the initial advance LVR falls within an acceptable range for lending against bare land. This is an important metric as it will dictate what funds you will be able to obtain to purchase a property or refinance an existing property before the development commences. At ASAP Finance, this threshold tends to sit between 60-75%.

The second test applied ensures that end (as-if complete) position meets LVR requirements. This is simply the full development facility measured against the ‘As If Complete’ valuation which assumes that the proposed development work is already complete. This is done by obtaining a valuation or assessing the value from plans and specifications against comparable sale data and listing. At ASAP Finance, we lend up to 75% of the completed project value for standard residential developments. Noting that the completed value can be inclusive or exclusive of GST depending on the nature of the project and the client’s intentions.

Consider your GST position

When calculating LVR’s for a property development you must consider your GST position. If you are in the business (or intend to be in the business) of buying, selling, developing, or building residential properties, then you will likely need to register for GST. This means that all the figures within your project feasibility should be on a GST exclusive basis (including the purchase price and end values of your property).

To calculate the GST exclusive value of a property, simply divide the end value by 1.15. For example, if you are building 8 townhouses worth $1,150,000 each, the assumed end value would be: (1,150,000 x 8 units)/ 1.15 = 8,000,000. As you can see, forgetting to take GST into consideration can have a catastrophic effect on your LVR position.

Choosing a Non-Bank Lender for Your High-LVR Loan

Maximum LVR thresholds differ significantly between main bank and non-bank lenders. Deposit taking institutions who operate in a heightened regulatory environment (RBNZ) have restrictive funding conditions that result in lower LVR thresholds. In contrast, non-bank lenders (especially those who have access to private funding) have greater flexibility as to the implementation of LVR’s, enabling them to finance projects that would otherwise not get off the ground.

Why choose ASAP Finance?

Our independence enables us to work with our clients to customise their loan terms to suit the development they are undertaking. By choosing ASAP Finance, you gain a partner in the development process. We avoid enforcing onerous conditions that are restrictive to funding enabling you to focus on what matters most.

We specialise in development finance – with over 50 years in cumulative development experience across the ASAP team, we offer valuable insight into the viability of a project that other lenders don’t have. All of our lending managers possess real world development experience. We are able to walk alongside you during the development, offering advice and guidance at times when they are needed most.

Fund your next project with the market leading non-bank lender in New Zealand.

We partner with investors, developers, and home builders, walking alongside them from application all the way to the completion of the loan. From short-term bridging loans to development financing, our bespoke lending packages are made to get your development off the ground.

Reach out to one of our highly experienced lending managers today to discuss your application ASAP.

The Ins and Outs of Lender’s Fees Explained

When developers are looking for a new build partner, they put their project out to tender. The evaluation process that proceeds is an intense and in-depth review of pricing, relevant experience, past performance, technical skills, resourcing, and other relevant factors. It is these factors that ultimately drive the decision-making process for the developer, ensuring that the right builder is chosen for the job.

Unfortunately, many developers forget to apply a similar process when choosing their funding partners, instead deciding to focus solely on price. This can result in bad outcomes for banks, non-bank lenders, and developers. Remember, the best funding partners are those that impart knowledge and value during the construction process, as well as offering a competitive price.

Nonetheless, having a robust understanding of pricing models and fee structures used by various lenders is an essential tool in a developer’s toolkit. After all, these fees can have a significant impact on a project’s feasibility. In this blog post we will focus on the various fee structures adopted by different lenders, keep in mind that price should not be the only factor one considers when choosing a funding partner.

Make comparison easier by annualising loan fees

Fees are often charged in relation to specified loan terms, which can make comparison difficult. An appropriate comparison can only be made using annualised fees and costs.

Luckily, headline interest rates are generally quoted on a per annum basis (i.e. 6.95% per annum). However, other fees fluctuate depending on the loan’s term, so annualising them is useful for accurate comparison. Once fees are annualised, we can then add them to the headline interest rate to calculate a finance rate for any given loan.

Types of Lender’s Fees

The Application/Establishment Fee

An application fee is paid upfront by the Borrower and is typically denominated as a percentage of the total Loan Facility. Application fees can range from 0.5% to 3.0% depending on the lender and the type of facility being provided. Upon commencement of the loan, the application fee is usually capitalised (added to the balance of the loan).

Development facilities are typically provided for a fixed term where the application fee corresponds to the term provided by the lender. If the term of the loan needs to be extended, then the application fee will be charged again (usually on a pro-rata basis). Therefore, it is important to annualise application fees.

Let’s look at an example where a lender provides a development facility of NZ$1M to a developer on the below terms:

Type: Capitalised Interest

Term: 6 months

Rate: 9%

Fee: 2%

Line fee: 0%

In this instance, the annualised application fee can be calculated as follows:

Annualised application fee = application fee / initial term * 12 months.

So, the annualised application fee would be:

2% / 6 * 12 = 4%

To calculate the finance rate, you simply add the headline interest rate per annum (9%) to the annualised application fee (4%), which in this case would imply a finance rate of 13%.

The Line Fee

Line fees are charged to compensate the lender for their commitment to lend or for holding unused funds in a facility. As mentioned in our blog on development loan structures, interest is typically only charged on the drawn balance of the loan. Therefore, line fees are a way for lenders to offset the lack of interest income generated during the term of a loan, where the average loan balance is well below facility limit provided by the lender. For example, on a development loan which is drawn down in stages, a lender will typically earn only 60% of the quoted headline interest rate in interest income during a 12-month loan.

The usual cost of a line fee is between 0.25% and 3.0% per annum, with the fee charged against either (a) the undrawn portion of the loan, or (b) against the total facility limit (similar to application fees). Understanding what portion of the loan the fee is being charged against is important as it can materially impact the cost to the Borrower. Furthermore, some lenders will quote you a line fee on monthly terms, while others will quote on yearly terms. For example, a 0.25% monthly line fee may not appear large, but on an annualised basis it amounts to 3% per annum, which is significant in the development world.

It is crucial at this point to state that establishment and line fees are not the only fees that may be payable. More recently, we have seen lenders introduce alternate pricing models that include minimum earn provisions, performance fees and exit fees. Other hidden costs such as site visit fees, drawdown fees and early repayment fees are not uncommon and need to be considered when undertaking a simple cost analysis.

Lastly, it is extremely important to identify and review any funding conditions required by the lender. Things such as valuations, requiring a quantity surveyor to be appointed to the project, or requiring pre-sales may seem appear to be standard funding conditions for development loans, however, each one comes at a specific cost which should be considered.

No matter the structure, it is always best to find a lender that is fully transparent with their clients as to what costs are involved. And remember: “Price is what you pay, value is what you get”.

Enjoy no hidden costs, fees, or hurdles with New Zealand’s market-leading property finance company.

From property development loans to bridging loans, ASAP Finance offers a bespoke funding solutions that enable you to get your next project out of the ground. All of our lending managers have development experience, so we understand how important it is to be upfront and transparent with our fee structures.

Start your journey to a completed project, and don’t deal with hurdles along the way. Reach out to an ASAP Finance lending manager today.

How Cost-to-Complete Funding Works in Development

At ASAP Finance, we work closely with our clients to understand their development finance needs, then craft bespoke funding solutions that transform property ideas to reality.

When we create a loan facility, we analyse each ‘input’ required to complete a project—considering elements such as planning, design, construction and delivery. In addition, we take into account the relevant experience of the developer and project. Finally, we apply these considerations against ASAP’s credit criteria which will ultimately determine how much we can lend to you: the Developer.

In some instances, we may be able to lend the full cost to complete the project. In other instances, the Developer may be required to contribute toward covering a portion of the project costs. If so, these funds need to be introduced into the project before our funding can be utlilised. This process is called funding on a ‘cost-to-complete’, and is a fundamental principal of construction funding.

The Process: What You Can Expect

(1) Before a development facility is put in place, a lender will require a detailed development budget to be prepared and submitted by the client. This will include items such as land purchase, soft costs (planning, consenting, professional fees), hard costs (civils and construction) and other line items such as utility connection charges, development contributions and appropriate contingency.

(2) Undertaking detailed due diligence, the lender will establish the total loan amount that they can provide to the client. The lender will work backwards to identify how much of the total development costs they are able to fund. The maximum amount a lender can fund will vary depending on their specific lending criteria. Any shortfall between the proposed loan facility and the total development budget will need to be funded by the client upfront.

(3) The developer’s equity is introduced into the project first to cover any shortfall between the lender’s loan facility and total development costs. This ensures that the lender is retaining 100% of the cost to complete the project within their loan facility.

(4) The size of the developer’s equity contribution will vary depending on the size of the lender’s loans facility. For example, the developer may be required to only cover some of the acquisition costs with the lender funding the design and build. In instances where there is a substantial shortfall, a greater equity contribution may be required, and the developer may need to complete the design, consenting and a certain percentage of physical works.

(5) Once the required equity contribution has been met, the lender will then fund the balance of the work required to complete the project. Future payments are always made on the basis that the lender’s loan facility continues to be equal to the projects budgeted ‘cost to complete’.

An example of a construction loan’s payment stages:

Let’s look at a simplified example where a developer wants to build some town houses on a previously acquired plot of land. For simplicity, let’s assume the total construction costs are $10 million and the lender has put in place a $6 million loan facility. This would require the developer to cover $4 million of costs (or 40% of total outlay). Their payment structure could look like this:

Client funded

Stage One: 20% – Site works, permits, foundations

Stage Two: 20% – Wall and roof framing

Lender takes over funding.

Stage Three: 20% – Cladding + Internal lining, plumbing and electrical

Stage Four: 20% – Internal fit-out and finishing including kitchen and bathrooms

Stage Five: 10% – Landscape and Driveway

Stage Six: 10% – Final payment and issuing of Code Compliance Certificate (CCC)

Why do lenders fund on cost-to-complete basis?

Keeping an accurate budget and a close eye on the cost to complete ensures a project can be taken to completion with the resources available. Lenders always prefer to fund the ‘back-end’ of the project as it affords them a degree of control over the construction budget and capital allocation. Funds are less likely to be misappropriated or allocated toward items that are ‘unfunded’ and that could result in a project running overtime and over budget.

The Advantages of Cost-to-Complete Funding with ASAP

At ASAP Finance, we work alongside our clients to assist them in building out feasibility studies and development budgets. This is done at a very early stage to ensure that the funding solution we put forward will be one that can take their project to completion. Each line item is reviewed with the client and in the end, a funding table is provided detailing who is responsible for funding each cost making it easy to track payments and project stages.

Choose experience, strong business acumen, and no hurdles. Choose ASAP Finance.

When funding on a cost-to-complete, the most important thing is to have a lender by your side that understands the intricacies of your project and one that prioritises the successful completion of your project. Reach out to ASAP Finance, one of the best development-focused finance companies in Auckland, today.

Three Loan Repayment Types Explained by Experts

Whether you’re seeking a bare land loan or looking for a comprehensive development finance solution, structuring your loan repayments to meet your cash flow requirements will enable you to control your risk and maximise your return.

Below is a comprehensive breakdown of the three repayment types; principal & interest, interest-only, and capitalised interest, and the scenarios they are most suited to. Ultimately, choosing a repayment method that suits you and your circumstances will go a long way toward facilitating your financial success.

Principal and Interest Loans

Principal and interest loans have two components, hence their name. The “Principal” is the initial loan amount borrowed from the lender, e.g. a bank or a company like ASAP Finance. The “Interest” is the cost of Borrowing and is the extra money accumulated on the Principal over the specified loan period. This loan structure is most commonly adopted by banks for consumer homes loans, and they are designed to pay off a loan over a defined period (e.g. 30 years).

Monthly repayments are fixed and at the beginning, your monthly repayments consist of a small portion of the Principal amount, with the majority of the repayment consisting of Interest accumulated for that month. With each repayment the Principal sum is gradually reduced, meaning the interest generated each month gets smaller. With the monthly repayment amount fixed, this means a greater portion of the repayment goes toward reducing the Principal amount, and a lesser amount towards Interest. The latter part of your loan term is mostly dedicated to paying off the Principal.

At ASAP Finance, our clients are typically developers and property investors in need of short-term loans, hence Principal and Interest Loans are not often used. Instead, our clients seek to increase leverage to maximise return on equity. That said, it is important to understand P&I loans and their role in the world of property.

Interest-Only Loans

Interest-only loans are commonly used here at ASAP Finance. After borrowing the Principal amount, investors will only pay the interest accumulated on the Principal for the loan’s duration.

In this situation, the Principal doesn’t need to be repaid until the loan period ends. This reduces the mortgage repayments during the term of the loan and allows investors to direct their capital to other productive assets. As property values rise over time, investors can generate equity in their properties despite the fact Principal repayments are not being made to the loan.

Interest-only loans also present potential tax benefits for investors. If interest paid on a loan is tax-deductible, then paying interest-only maximises that deduction for the investor. Banks and other lending institutions typically offer a fixed term for Interest-only Loans, with the most popular period being about five years, after which the loan can revert to P&I or the Borrower can simply repay the Principal all at once.

However, interest-only loans also have a high degree of risk. The Principal still needs to be repaid and opting for an Interest-only structure defers this obligation and increases the total repayments required to repay the loan. Furthermore, funding costs can significantly increase when the term of the loan expires, and P&I repayments are required. Lastly, it is important to remember that should the property depreciate, you could end up owing more than the property is worth.

Is interest-only for you?

This loan type is for you if you are a property investor who is confident with managing money (often useful with commercial and industrial property finance). Astute borrowers can optimise their tax position and benefit from the lower repayments, weighing the rising equity of their property against the interest repayments and Principal amount. By the time the interest-only period ends, you should be able to repay a significant portion of the Principal as long as you’ve adequately managed your assets during the loan’s term.

Capitalised Interest

A capitalised interest loan is our most popular loan structure. It is suited for property developers and in the primary repayment type used in development finance. Instead of paying a monthly interest expense, the interest is ‘capitalised’ onto the Principal amount each month. Once the loan matures, the Borrower repays both the Principal and the accumulated interest in full.

Most developers have their cashflow committed towards the project they are working on, making monthly repayments difficult. Lenders in the development finance industry also have a preference to adopt capitalised interest repayments as it underscores one of the most fundamental funding methods in development finance; funding on a ‘cost to complete’ basis.

Funding on a ‘cost to complete’ basis is where the lender retains 100% of the cost to complete the project, no matter what stage the project is at. Under this scenario, Interest repayments are viewed as a project cost, meaning the lender will retain the total expected interest cost within their loan facility. Each month, interest is drawn from the ‘capitalised interest facility’ and applied to the balance of the loan.

One of the important things to note about a capitalised interest loan facility is that interest is charged on the drawn portion of the loan, so the amount capitalised onto the Principal is not static from month to month.

For example, you may only draw 20% from the Loan Facility in the first two months of work, so interest is only charged on 20% of the Principal. At six months and 60% drawn, interest is charged on 60% of the loan amount.

Is capitalised interest for you?

Simple: this loan structure is for you if you are a developer. Adopt a clear plan for your development and you’ll be able to repay the Principal and interest upon completion of the project.

Funds for construction and development loans are only drawn down from the Loan Facility as and when they are required to fund each stage of the build. Smart borrowers with a clear plan for their developments can capitalise on this structure due to its unique interest scheme, as the actual interest paid by the Borrower is typically between just 55% to 70% of the headline interest rate charged by the lender.

Furthermore, delaying the interest liability gives the Borrower time to generate revenue before they must repay the loan amount.

Talk to the leading property finance company in Auckland about which loan structure suits you.

Our lending managers are experienced in all areas of property development, and we tailor a bespoke loan package to suit your needs. Talk to the Kiwi leaders in non-bank property finance for a hassle-free lending journey today.