Tag: construction loan

The Capital Stack – What is it and why does it matter?

The Capital Stack

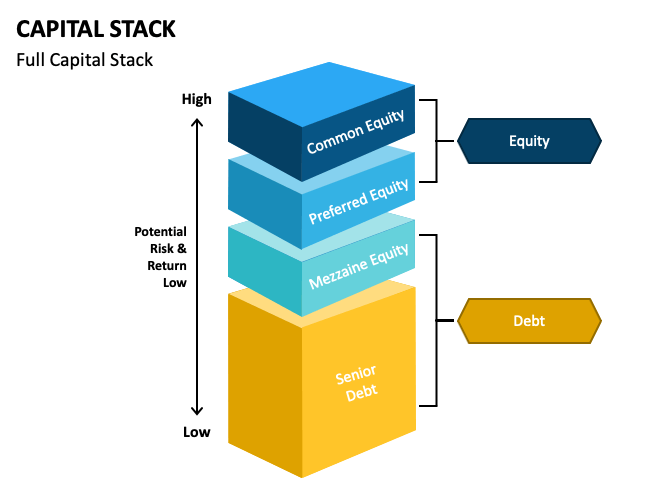

When it comes to property development, one of the most important concepts to understand is the capital stack. In simple terms, the capital stack refers to the different sources of financing that are used to fund a property development project. These sources of financing can include equity, debt, and other types of financing.

Understanding the capital stack is crucial for property developers, as it helps them to determine the most appropriate financing structure for their project. By carefully balancing the different sources of financing in their capital stack, developers can optimise their overall cost of capital relative to their expected return on investment.

Let’s take a closer look at the different components of a typical capital stack:

Senior Debt

Senior debt is typically the first layer of financing in a capital stack – such facilities are commonly provided by banks but also include non-bank lenders and finance companies (such as ASAP Finance).

Senior debt takes priority above all other financing including mezzanine debt and equity – priority is secured by way of a first ranking mortgage registered on the certificate of title of the property. Other securities such as General Security Agreements, Deeds of Assignment, Deeds of Priority and Subordination, Specific Security Agreements and Personal Guarantees are also common in development funding. These securities ensure the lender has the first claim to any proceeds of sale resulting from the development.

Lending criteria for senior debt facilities can vary greatly, however almost all will have loan-to-value and loan-to-cost requirements. Minimum equity contributions are also common, ensuring developers have skin in the game.

The priority status of senior debt makes it less risky, but as a result it also commands a lower return for the lender.

Mezzanine (Junior) Debt

Mezzanine debt or Junior debt is a type of financing that sits between senior debt and equity in the capital stack.

It is typically secured by way of a second registered mortgage (behind an existing first) or in some instances may be unsecured.

Because it ranks lower in terms of priority, mezzanine debt is higher risk lending and carries a higher interest rate than that of senior debt, however it is cheaper than equity funding.

Equity

Equity represents the capital that is invested in a project by its owners or investors. Equity investors take on the highest risk in a project, as they are typically the last to be repaid and have no guarantee of a return on their investment. However, they also have the potential to earn the highest returns if the project is successful. If a developer is short of their own equity, they can look to raise equity from investors however given the risks, it is also typically the most expensive form of financing.

Preferred Equity

Preferred equity is a type of financing that sits between mezzanine debt and common equity in the capital stack. It typically carries a fixed rate of return and priority over common equity investors in terms of repayment.

Common Equity

Common equity represents the ownership of the property development project. Common equity investors take on the highest risk in a project, as they are typically the last to be repaid and have no guarantee of a return on their investment. However, they also have the potential to earn the highest returns if the project is successful.

Why Does This Matter?

By carefully balancing the different sources of financing in their capital stack, property developers can create a financing structure that is both cost-effective and tailored to their specific needs. For example, a developer may choose to use more of equity in their capital stack to maximise returns, or more leverage (senior debt + mezz) if they are looking to maximise total returns on equity across multiple projects.

Overall, understanding the capital stack is crucial for property developers looking for property development funding. By carefully considering the different sources of financing available to them and creating a well-structured capital stack, developers can minimize their overall cost of capital and maximize their potential returns.

10 Questions From Your Development Funder (Pt. 2)

10 Questions Lenders Ask When Funding Property Developments (Part 2)

Welcome to part two of our blog series, where we explore the top 10 questions lenders and finance companies in Auckland will ask during the application process. The previous blog post covered the first five questions lenders will ask. In this instalment, we will delve into questions 6-10 which span everything from your initial funding requirements to GST implications. Let’s take a closer look!

(6) What is your funding requirement?

For obvious reasons, your development funder or non-bank lender needs to know how much funding you require. This can normally be broken into two components.

- The Initial Advance (used to assist with a refinance of an existing mortgage, or an initial cash advance towards land settlement); and

- The Progress Payment Facility (to be allocated toward project costs on a cost-to-complete basis)

Most development funders will lend on a first-mortgage basis only, meaning any existing mortgage must be refinanced as part of the finance package. You must consider this part of your ‘funding requirement’.

Lenders will assess your funding requirement against internal guidelines for loan-to-value (LTV) and loan-to-cost (LTC) ratios. It is important to remember that each project is assessed on its own merit and these ratios may vary depending on the location and type of project.

Be prepared to discuss your project budget at a high level. These include things such as land acquisition costs, construction costs, and subdivision costs. Lenders will assess square meter rates and whether your construction construction costs are realistic. Anything that doesn’t quite stack up may raise a potential red flag for your project, including low construction costs or inflated land prices.

When applying for development funding with ASAP Finance, we thoroughly review your project budget in detail to ensure that you have included all costs required to complete the project. This should include allowances for: professional fees, council fees (such as development constitutions), utility connections, civil works, and construction as well as an appropriate contingency.

(7) What is the development programme?

Lenders will want to know how long the development is expected to take, as this will impact their risk assessment. A longer development timeline may increase the lender’s risk, while a shorter timeline may decrease it.

Lenders will use this information when considering an appropriate loan term. However, this is something you the developer should also consider. Should you accept a loan term that is shorter than your development programme you expose yourself to opportunistic lenders who may look to re-price your loan or provide unfavourable loan extension terms. Keep in mind that finding a new lender mid-construction is extremely difficult so your options will be limited.

(8) What is your plan for repaying the loan (exit strategy)?

Whether you plan to sell the completed development or retain the properties, discussing your plan for repaying the loan is crucial at the start of the funding process.

Do you intend to retain the properties after completion? You lender will need to see that you have the financial capacity to meet the long-term mortgage requirements of traditional lenders such as major banks or ‘near bank’ lending institutions.

If you plan to sell the units, your lender will want to know what your sales strategy will be and if you have any pre-sales prior to drawing down. Your sales strategy should encompass whom you intend to market and sell the properties, likely asking prices and when you plan to start marketing the development. Any presales should be bank quality as we discussed in our guide to exit strategies.

Holding or selling the properties on completion will also have implication on the way GST is treat and internal LVR calculation for the lender.

(9) Are you GST registered/have you and will you be claiming GST?

The majority of the projects we fund are built to sell. Thus most of our clients will be GST registered and will have claimed GST against the purchase price of the land purchase and will similarly be claiming GST on construction costs. This also means that GST will be payable when you sell down the units.

If GST is payable on the sale of the houses on completion, we need to deduct GST from our end values when calculating LVRs. For example, if we decided the maximum LVR for a project is 70% against an as-if complete value of $1,000,000 including GST, then the maximum loan facility we could offer would be c.$608,000. [Calculated as $1,000,000 / 1.15 (GST) x 70%].

If a client GST registered (and is claiming GST) we can fund projects on a GST-exclusive basis, using a separate GST facility to fund the GST. A GST Facility is a revolving credit facility that is used to exclusively fund the GST portion of a Progress Payment. Funds drawn down from this facility to pay GST are repaid by the IRD in the form of a GST Refund. Using a GST Facility enables a lender to fund a project on a GST-exclusive basis, at the same time ensuring that all contractors are paid in full (the GST inclusive amount). In other words, using a GST Facility reduces the amount you need to borrow from a lender by approximately 15% (less the GST facility itself).

(10) Who have you engaged as your main contractor/who are your key project consultants?

In our experience, the most successful property developers are those who have built the best team. This spans everything from solicitors, accountants, contractors and other project consultants.

As a lender, we will be interested in understanding your consultants’ and contractors’ qualifications, experience, and track record of completing similar projects on time and on budget.

Having a team with relevant qualifications, insurance and licenses, it will demonstrate to the lender that your project is managed by experienced professionals who are able to effectively oversee the development and navigate any potential challenges that may arise.

Having a reputable, experienced and well-respected project team will not only help ensure the project is completed on time and on budget, but it also reduces risk for the lender, increasing your chances of securing funding.

Be prepared

Securing funding for your property development can be challenging, but understanding what information is relevant to your lender can make the process less daunting. By understanding and learning how to address common questions lenders ask, you can increase your chances of securing funding. When considering your application, lenders look at a variety of factors such as location, development nature, project team, exit strategy and more. By being aware of these factors and knowing how they align with your project goals will enable you to present a strong lending proposition. Remember, a lender wants to invest in feasible projects backed by a good team and have a good ROI. Keep these in mind so you can increase your chances of success.

10 Questions From Your Development Funder (Pt.1)

10 Questions Lenders Ask When Funding Property Developments (Part 1)

Securing funding for your property development can be challenging , but understanding what information is relevant to your lender can make the process less daunting. This blog post will be the first in a two-part series where we break down some of the critical questions you can expect a lender or property finance company to ask, so that you can better prepare for your next development funding pitch.

Please note that this is not an exhaustive list nor a comprehensive guide to all the questions your lender may ask. Instead, we are aiming to provide insight into some of the more common questions lenders pose, and the reasoning behind why they are relevant. Lenders use these discussion points to determine whether your project fits their credit criteria.

Here are some of the questions you can expect, along with the reasoning behind why they are crucial:

(1) Where is the project located/what is the property address?

Lenders will often have different criteria based on geographic locations. ASAP Finance prefers to offer property developments loans for projects in main urban centres such as Auckland, Hamilton, Tauranga, Wellington, Christchurch and Queenstown. This is primarily due to the greater liquidity (transaction volume) in these markets, making it easier for clients to a sell property and repay their loan(s).

The specific property address reveals more detailed property attributes, such as whether the property is in a desirable area, site aspect, contour of the land, location to services and amenities, and underlying zoning. As lenders, we must look out for any property attributes that make funding your project more challenging, such as a poor location or lack of access to services.

(2) Who owns the property/what entity will be undertaking the development?

The property owner tells us who the borrower will be. Most clients undertake projects under a Limited Liability Company (LLC). However we also fund projects where the development is being undertaken under a trust, limited partnership, or personal name. We recommend seeking professional advice from your accountant concerning the best structure to use for your project.

If the project is to be undertaken by an LLC or other investment vehicle, we will want the director and key sponsors to guarantee the loan. Understanding the parties involved in the transaction, and the role that each party will play, is something we will cover with you as part of the application process.

Properties owned under personal names can be an issue. This is because there may be CCCFA implications if the property is owner-occupied. Many non-bank lenders do not write CCCFA loans, which means if the property is owned under a personal name and is owner-occupied, we will not be able to assist you with your project.

More complex structures such as trusts and partnerships have a high threshold for AML, and may also require a more detailed explanation as to how partners are introducing equity in the project and the source of those funds.

(3) What is the nature of the project, i.e. what are you proposing to build?

Of course, each lender needs to know what they are funding, but understanding what you are proposing to build also gives us further insight into the overall feasibility of your project. We will be assessing:

- The complexity of your proposed development and relative risk weighting (e.g., residential townhouses, apartment complexes, and subdivisions all have different risk attributes).

- Whether your product is suited to the location you are proposing to build in.

- The expected demand for your product in that location.

- Whether your costings accurately reflect what you are proposing to build.

(4) What stage of the development lifecycle are you in? Have all necessary consents been obtained to begin the project?

Lenders generally priortise build-ready transactions (ie. ready to draw down) versus those further away from starting construction.

Most funders will only provide full development facilities when they know construction can begin shortly thereafter. Approving a loan that is too far away from drawdown increases the risk of the market changing between the approval and when construction starts.

Rule of thumb: apply for development funding when you have your resource consent, engineering approvals, and your building consent has been lodged (but is yet to be approved).

(5) Do you have any previous experience in property development?

We will want to know if you have any previous experience in property development, as this can provide insight into your ability to complete a project successfully. Lenders will look for a track record of completed developments and assess your ability to complete the project successfully. Building a CV to showcase recently completed projects is an excellent way to demonstrate your capabilities. For those new to development, focus on building your development team – to a certain extent, the experience can be bought!

Next steps

Securing funding for your property development can be a complex process, but understanding the relevant information your lender can make it less so. This blog post is a two-part series that aims to break down some critical questions you can expect your lender to ask. Stay tuned, for part two where we explore further questions your lender may ask.

Exit strategies

Formulating a robust exit strategy is a critical part of the development process. When assessing an application for a development loan, the credibility of a clients’ proposed exit strategy will be reviewed and assessed in detail.

There are several ways a developer can exit a construction loan – the most common strategies being:

- to sell the development down, or

- to hold (and refinance any residual debt).

No matter the strategy, a lender’s comfort around this area of the transaction is paramount as this is how they expect to be repaid. Failure to clearly demonstrate how funds will be repaid and how you can execute on your strategy will likely result in the funding application being declined.

Learn how to create an exit strategy properly below.

Recycling Profits

Selling down completed stock (be it dwellings or sections) to realise profits is the most common exit strategy property developers adopt. This strategy enables profits to be recycled from one project into another upon completion. This “rinse and repeat” model enables developers to quickly scale their business and grow profits.

Many lenders will lend more aggressively against a ‘sales strategy’. This is because a ‘refinance’ (or ‘hold’) strategy requires the residual debt upon completion of the project to be refinanced. This means that any initial development funding provided by the initial lender cannot exceed an amount the developer will be able to borrower in the refinance market.

Refinancing requires the developer to meet servicing criteria (at a future point in time) which is largely unknown when they start construction. Because lending criteria (and interest rates) are constantly in flux, development lenders will be conservative when providing funding to clients to intend to hold their product.

As a result of the above, most lenders will lend more aggressively when the developer adopts a ‘sale strategy’. This means that selling down properties is a less capital-intensive compared to holding – not only because they can obtain greater leverage but also because the developer’s equity is not tied into the project over the long-term. Therefor, a developer’s return on equity tends to be higher over the short term.

Of course, there is an argument for both exit strategies as over the long term, holding can generate capital gain that can exceed any short-term gain generated through development.

Pre-selling & Lending Criteria

Mainstream lenders such as banks typically require a certain number of pre-sales as a pre-condition to funding construction. In today’s environment, most NZ banks require between 100-130% presale cover to ensure that their debt can be repaid in full upon completion of the project. One of the reasons that (some) banks insist upon a pre-sale cover greater than their debt facility (say 130%) is to ensure that their debt can still be repaid should some purchasers default.

In contrast non-bank lenders have more flexible terms and can fund projects with no (or a limited number of) presales. They also have greater flexibility when determining what constitutes a ‘qualifying presale’.

If you have decided to obtain pre-sales, our suggestion is to always seek ‘bank’ quality pre-sales where possible (regardless of the individual lender’s requirements). Bank quality presales can be typically defined as follows.

- Unconditional (subject only to the issuance of title and CCC)

- Independent contracts sold through an agent

- No related party sales

- Minimum 10% deposit paid (for NZ residents, 20% for non-NZ residents) and held in a solicitors trust account

- Terms consistent with the proposed plans for the project

- Appropriate sunset dates are usually +12 months after the expected completion date

- Sales to individuals (as opposed to a company or trust). If a sale is to a company or a trust then obtain a supporting guarantee from the Directors or Trustees.

- Avoid multiple sales to the same party (as they will typically not be accepted)

Following the above principles will put you in a good place to obtain funding from most lenders.

Should You Pre-sell?

Pre-selling has its perks when it comes to risk management however making such a decision will likely have broader implications for your project, particularly its profitability.

Below we look at some key points developers should consider when making this decision:

Risk mitigation

This one’s obvious – there is a reason that lenders insist on pre-sales. Pre-selling locks in revenue and protects your downside in the event of a decline in property prices. It also establishes a robust (often bankable) exit strategy via a watertight contractual arrangement. Selling at the end of a project will expose the developers to changes in market conditions leading us to our next point…the property cycle.

The property market is cyclical

A firm grasp on what stage of the property cycle we are in will enable us to make more informed decisions when it comes to risk management and risk mitigation. Pre-selling in the growth phase will likely result in you leaving money on the table. A good example is a client who was building two-bedroom townhouses in Epsom, Auckland in 2020. Feedback from real estate agents (and an RV) had suggested an end value of $1.0m per unit. However, our client could see that the market was taking off and was convinced that his product would present better on completion. He decided not to pre-sell, instead listing his properties when they were nearing completion. Between starting construction and completion, the market had moved substantially and our client sold all ten units for greater than $1,150k per unit, a +$1.5M gain in revenue for the project.

Cost Escalations

What is the likelihood of cost escalations during construction? In recent years, property prices have skyrocketed; however, so too have construction costs. This created an interesting predicament for some developers who had sold off-plan. By pre-selling, you are locking in your revenue. This means that any increase in cost (no matter how minor) will directly impact profitability. We all saw the news article in 2021 where developers were trying to renege or renegotiate on pre-sale contracts. This is because construction cost escalation during the build had eroded their profits. In the meantime, property prices were well above their initial presale prices, giving them the incentive to try cancel presales to recapture a project’s margin. In such circumstances, ensuring that construction costs are fixed before starting a project, and retaining/holding back some stock are just some ways to mitigate the impact of escalating construction costs.

Off-plan discount

It is commonly accepted that selling off-plan/before the project has been completed results in the developer selling at a slight discount to market (up to 5% of the purchase price). This can be for various reasons including uncertainty about what will be delivered, time delays, hesitancy on what direction the market may head and so on. However, this is not a blanket rule. Some developers take advantage of this using comprehensive marketing packs and high-quality renders to upsell their development.

Supply and demand: understanding what competing stock is planned for delivery (and when) should inform your sales exit strategy. You may decide to sell on completion if there is no competing stock. If there is lots of competing stock, then it will likely be harder to sell on completion and days on the market will increase. If you are fully drawn on a construction facility, holding costs will quickly erode your development margin. In this instance, pre-selling (at least some) will enable you to reduce debt and de-risk your project.

Price validation: while agents and valuer’s provide an incredibly valuable service, even they can be wrong. If you are building an unusual typology or intend on building a product that is new for the area, then pre-selling will enable to you to test the price point of your product. This will underline revenue assumptions in your project feasibility and allow you to move forward with your build with confidence.

Developing a Sales Strategy

There is no one size fits all approach when it comes to developing a sales strategy. For this reason, instead of detailing an effective sales strategy we have posed some questions which we encourage all our clients to consider before launching their sales campaign.

A good sales agent will help develop a comprehensive sales strategy, and thus we suggest obtaining multiple proposals from various agencies (similar to a tender process) before committing to any one agent.

- Who is the best sales agent to represent you – is there a particular person or agency who would be best suited to sell your product?

- What is the best fee proposal to incentivise your sales agent?

- When is the best time to commence marketing?

- Are you going to pre-sell off plan or sell closer to completion?

- How much stock do you want to release and when? Are you looking to sell 100% of your product before commencing construction or simply sell as many as you need to unlock funding.

- Will one typology be harder or easier to sell compared to another?

- Will selling one product first create a price floor or ceiling for unsold stock?

- How are you going to market your product i.e. what sales channels are you going to use?

Don’t get caught out

Undertaking a development without an exit strategy in place not only undermines your ability to obtain funding but can severely impact the viability of your project.

Pre-sales protect your downside; however, it can come at a cost. Deciding to sell on completion is still a viable strategy, so long as you clearly demonstrate how you will execute this and its rationale.

Being fully drawn on a construction loan facility with no exit in place will result in you incurring unnecessary holding costs which can quickly erode a project’s profit.

Be prepared on how to create and exit strategy; talk to ASAP Finance about funding your next project.