Client background & challenges

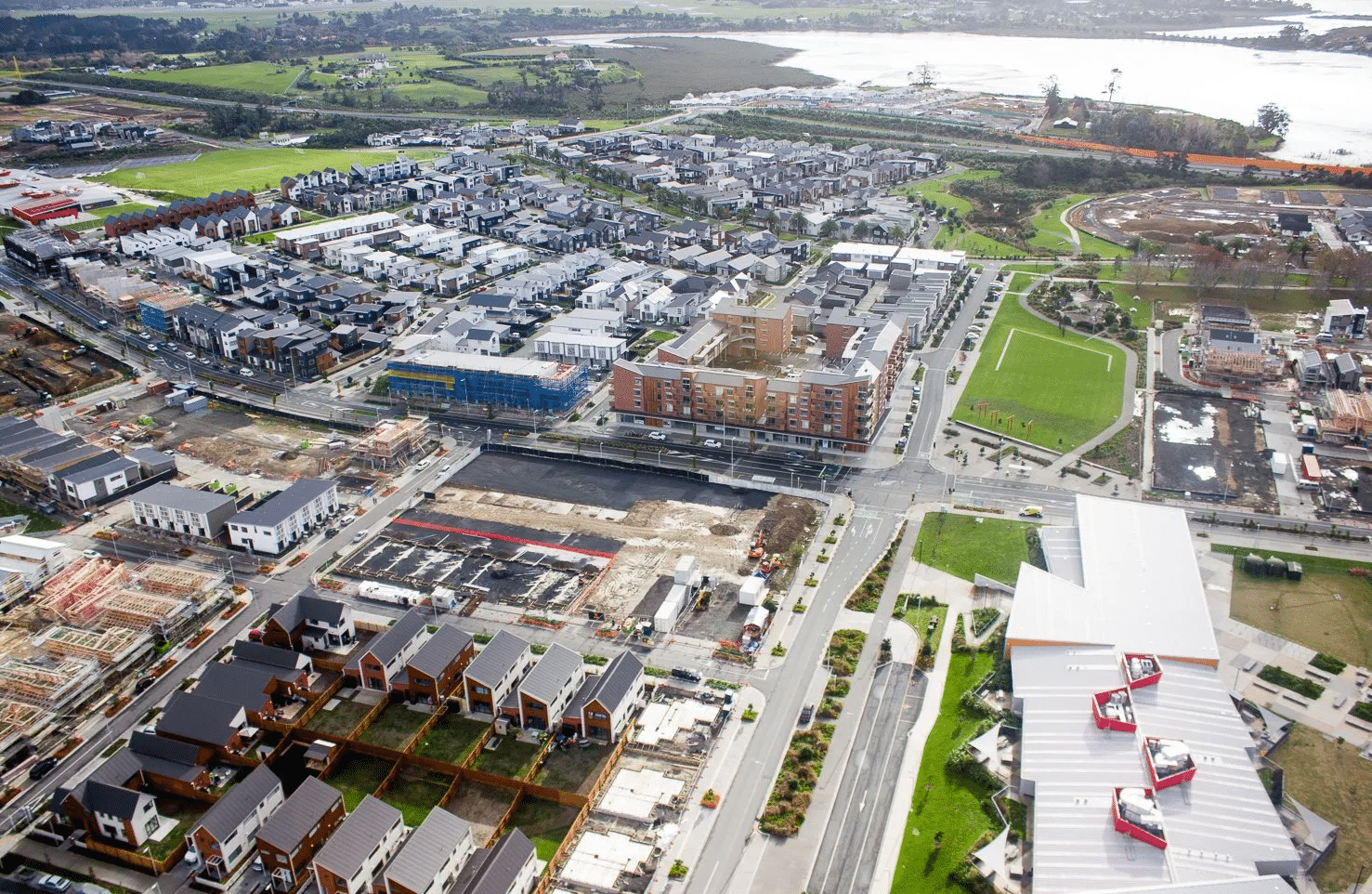

The well-known property developer and home builder had successfully completed a subdivision in Hobsonville Point, Auckland, with newly titled sections that were unencumbered. However, having invested heavily into the subdivision works, the group had become capital constrained and required additional funding to move into the most demanding and capital-intensive stage of the project – the vertical construction of homes.

When approaching the market for finance, the client encountered several challenges:

- Bank reluctance – Traditional lenders were constrained in how they viewed the lending proposition. The facility was assessed as a large-scale construction loan, which banks had little appetite for, particularly given the size of the funding requirement and the fact it spanned multiple sites.

- Pre-sale hurdles – In line with the above, mainstream banks required pre-sales for the houses before releasing construction funding, even though the developer already had significant equity in the land. This condition would have delayed construction and introduced uncertainty in a softening Auckland housing market, where time-to-market was a critical success factor.

- Reporting requirements – QS reports, valuations, and ongoing project monitoring demanded by banks added unnecessary costs, slowed down drawdowns, and became a barrier to efficient project delivery. These requirements not only eroded project margins but also created administrative delays that impacted the construction programme.

- Time pressure – With contractors and trades scheduled to begin work, the developer faced tight deadlines. Any delay in securing funding would have jeopardised the delivery programme and risked significant cost escalation.

As a result, traditional bank loans were neither attractive nor viable. The developer needed a non-bank development finance partner with the speed and flexibility to move the project forward.

ASAP Finance’s solution

ASAP Finance structured a bespoke solution that addressed the developer’s challenges:

- Different lens of lending proposition – Unlike traditional banks that categorised the deal strictly as a construction loan (and therefore applied rigid requirements), ASAP Finance approached the facility as a staged equity release. By taking into account the client’s strong equity position in the land and focusing on how funds could be drawn progressively, ASAP was able to unlock capital efficiently without unnecessary conditions.

- On-demand cashflow facility – ASAP provided a $20m loan facility that allowed the developer to draw down funds as required. This flexibility ensured the client could meet payment schedules with contractors and suppliers without bottlenecks. Because the facility was fully on-demand, the developer had the freedom to allocate capital wherever it created the most value across the project.

- No pre-sale requirement – Unlike mainstream banks, ASAP Finance did not require pre-sales as a condition of funding. This gave the developer the ability to focus on construction and timely delivery rather than being delayed by early-stage marketing campaigns. Homes could be completed and released to the market faster, aligning with demand in Hobsonville Point.

- No hidden costs or minimum drawdowns – The facility carried no minimum day-one advance or “minimum earn” requirements. Interest was charged only on funds actually drawn, ensuring the cost of the facility was directly tied to utilisation. This structure gave the developer full control over cashflow while keeping financing costs efficient and transparent.

- Streamlined process

- No external QS reporting – ASAP’s in-house property and construction expertise enabled milestone-based drawdowns without the added cost or delay of third-party QS reports.

- Direct collaboration – ASAP worked closely with the client’s legal and advisory teams to ensure settlement within tight timeframes.

- Tailored loan structure – The loan was secured against the subdivided lots, maximising borrowing capacity while maintaining prudent risk management.

Outcomes

With ASAP Finance’s support, the client was able to:

- Commence construction immediately, without waiting for pre-sales or lengthy approvals.

- Maintain strong contractor relationships by meeting all payment schedules on time.

- Accelerate delivery across 90 residential homes, bringing much-needed supply to Auckland’s housing market.

- Optimise capital allocation and enhance project value, achieving an end value of $33.5m against a $20m facility.

This case highlights how ASAP Finance’s flexible property development funding solutions enable developers to unlock opportunities that traditional banks cannot. By removing barriers such as pre-sales and QS reporting, developers gain the confidence and certainty to complete projects at scale.

Why Developers Choose ASAP Finance

For over 20 years, ASAP Finance has specialised in non-bank property development lending across Auckland and New Zealand. Our funding model is designed for developers who need:

- Speed and certainty of funding

- No pre-sale or QS requirements

- Flexible loan structures tailored to each project

- A partner with real property development expertise.

Whether you’re funding a large-scale subdivision, townhouse development, or multi-stage project, ASAP Finance provides the capital and support to get your project off the ground.